Has ASML Reached the Great Wall of China?

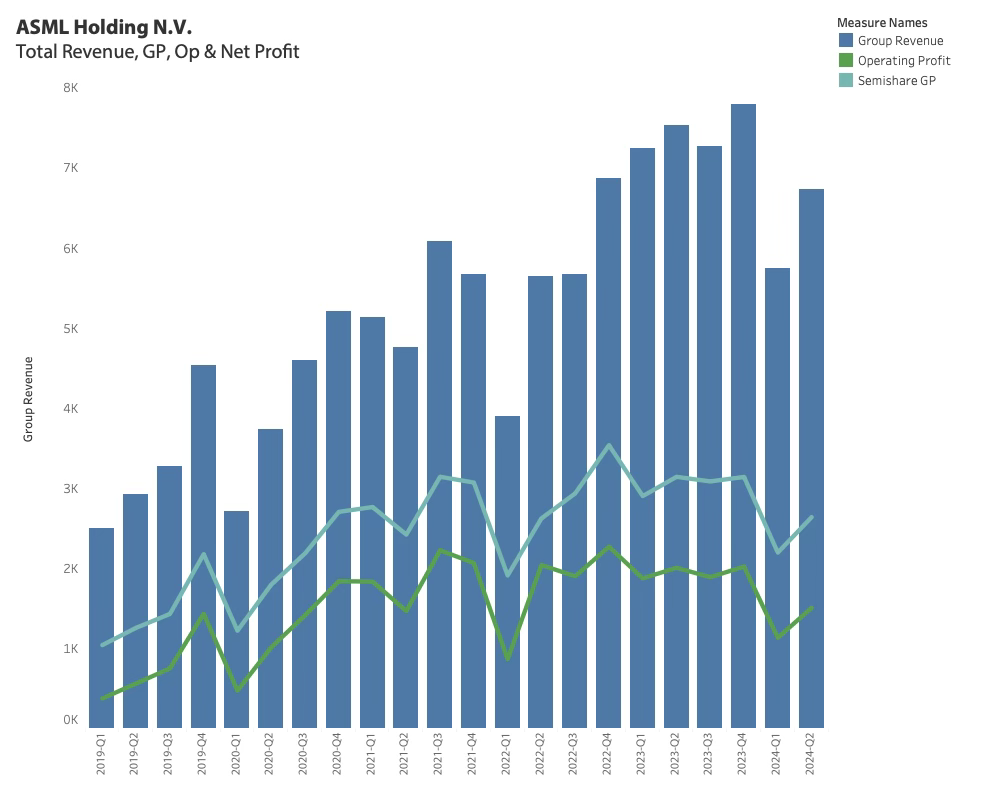

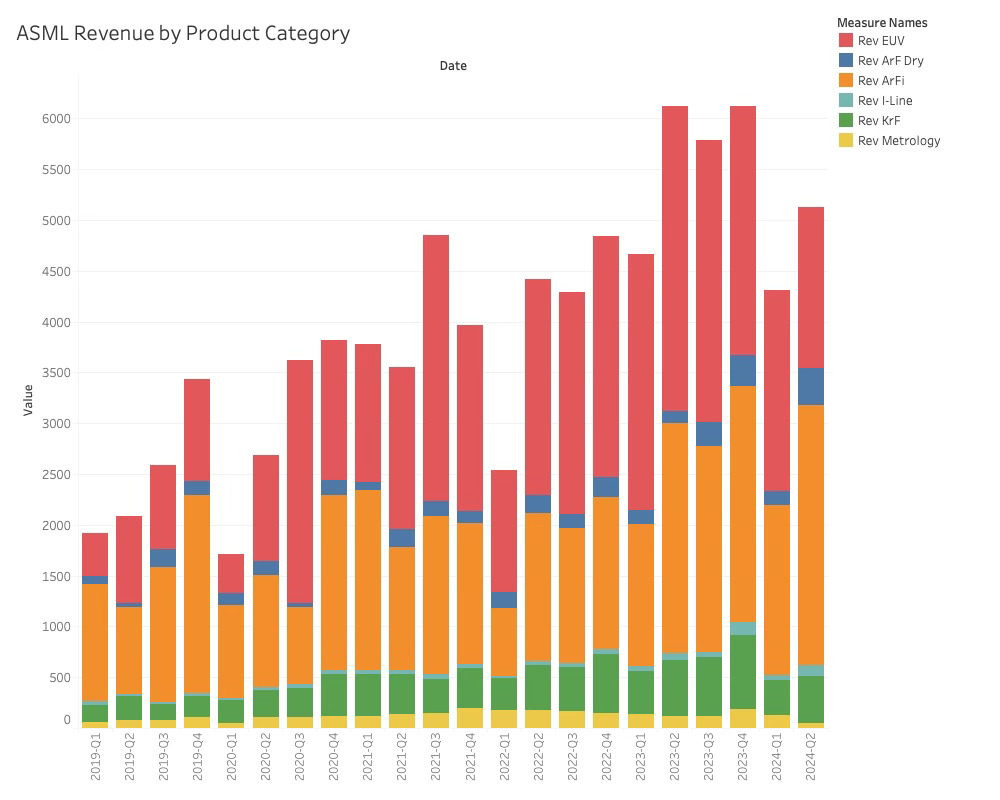

The first tool company to report Q2-24 results is ASML, and the lithography leader delivered a result above the guidance of EUR5.95B. Revenue of EUR6.242B is 4.9% above guidance and 18% above last quarter’s result of EUR5.29B.

Both operating profit and gross profit grew but not to the level of the end of last year. ASML management calls 2024 a transition year in investor communications, indicating a stronger 2025.

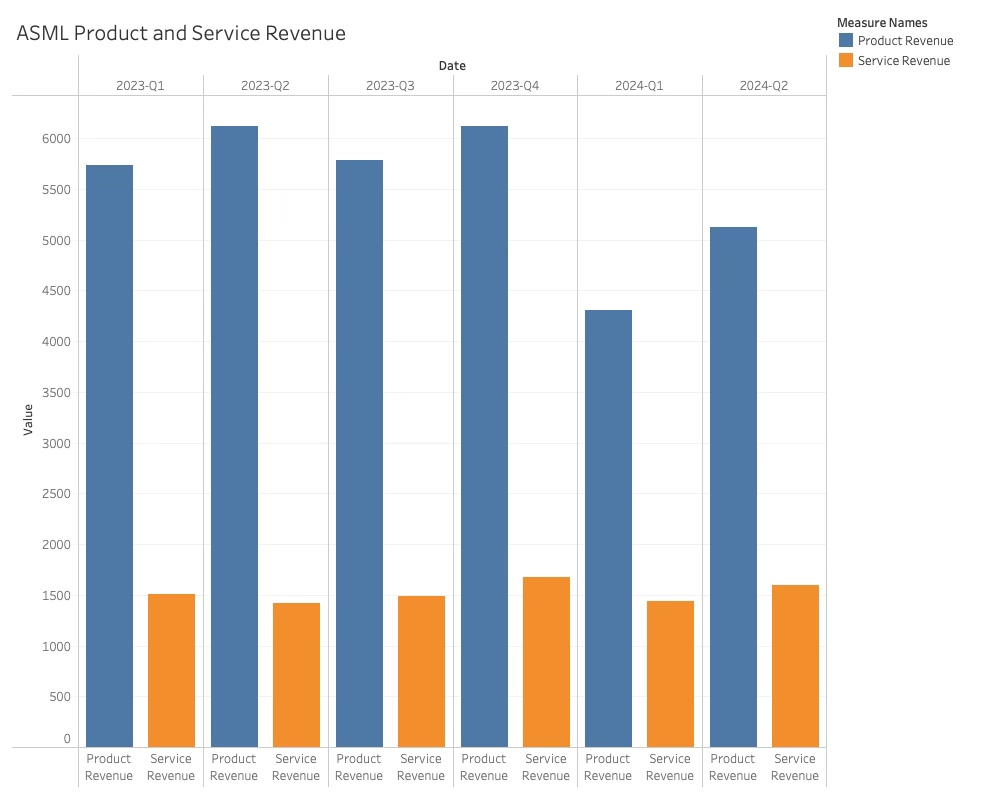

Tool revenue increased after a significant dip. Service Revenue is much more resilient than tool revenue, as it is dependent on the installed base of tools.

Almost all of the tool revenue growth came from memory tool sales, indicating that the memory companies are finally ready to make substantial investments in new capacity, which is much needed after the shift to HBM production.

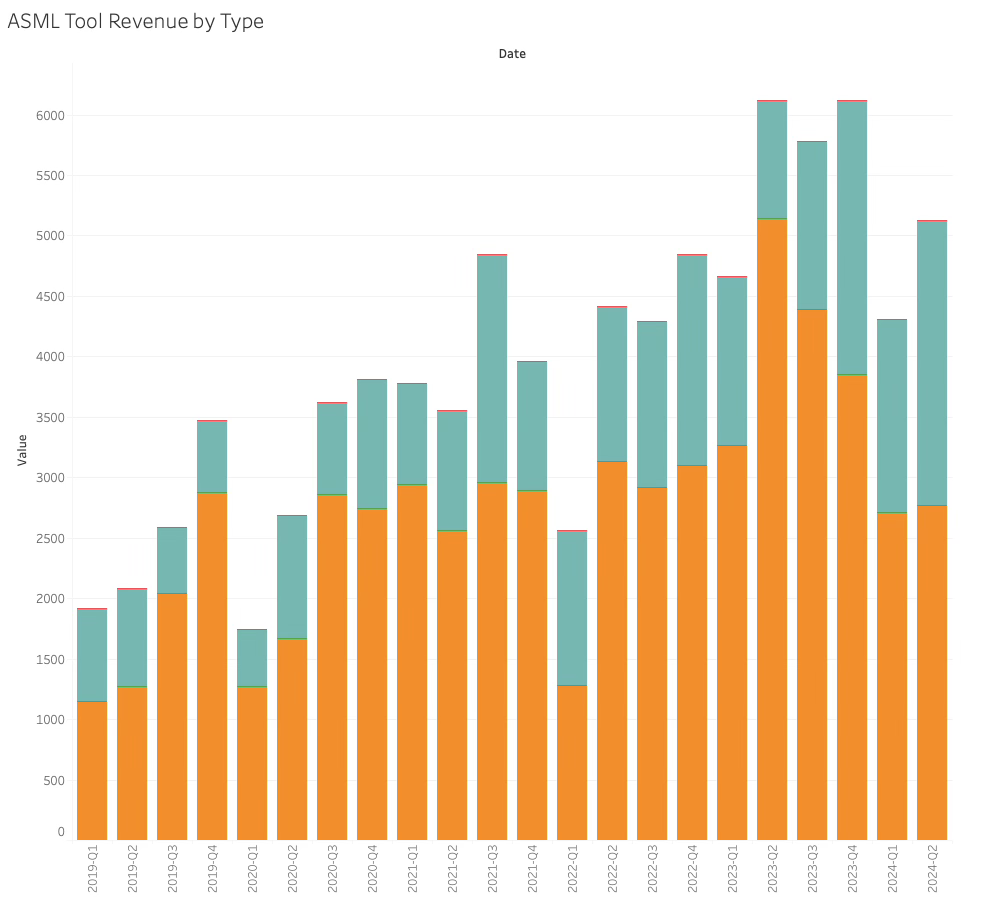

From a product perspective, the short-term trend of EUV revenue decline continued while the immersion product sales were solid.

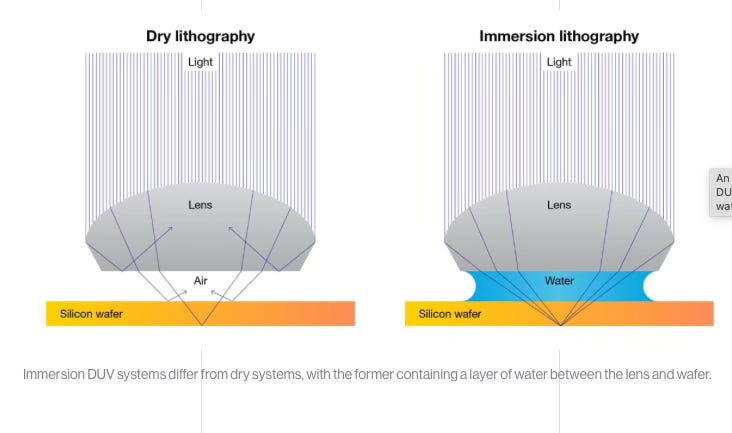

Immersion is a technique that utilises that light through water, resulting in amplification, allowing better resolution at the same light wavelength.

Given the Chips Act and other subsidies, the ASML result is somewhat counter-intuitive as EUV is used for 3-7nm leading-edge manufacturing nodes, and immersion is used for 7-14nm. Given the US attempt to become a leading-edge manufacturing location, it could be expected that leading-edge tools would dominate revenue. This indicates that the new factories are not yet in the tooling phase.

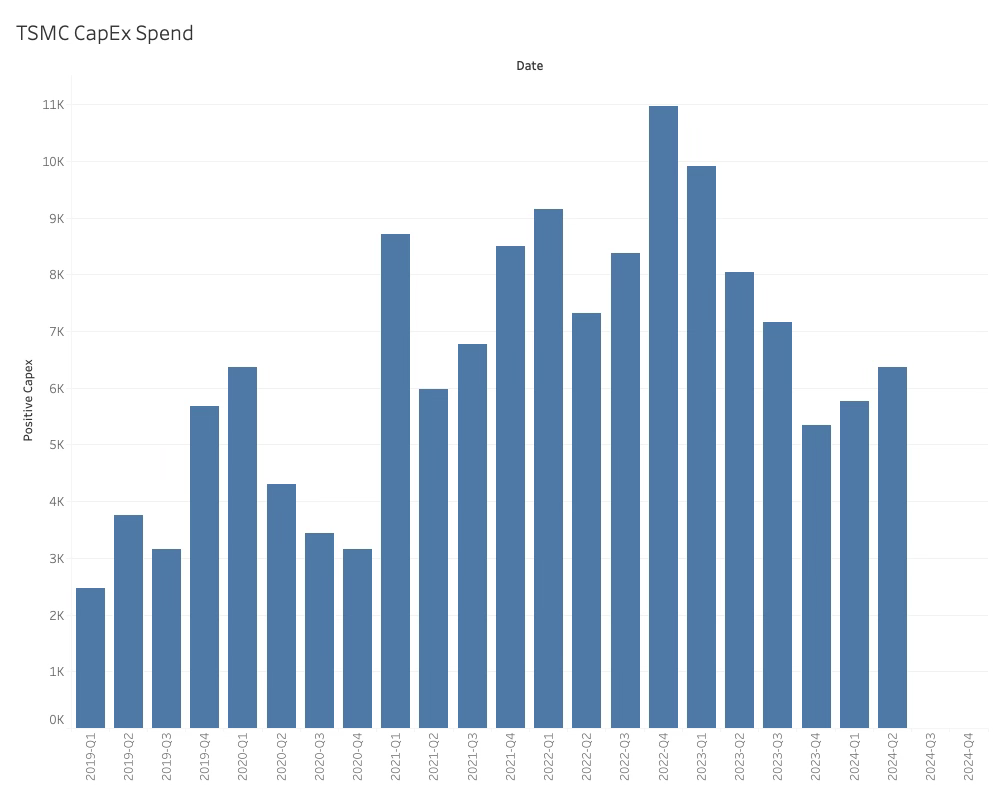

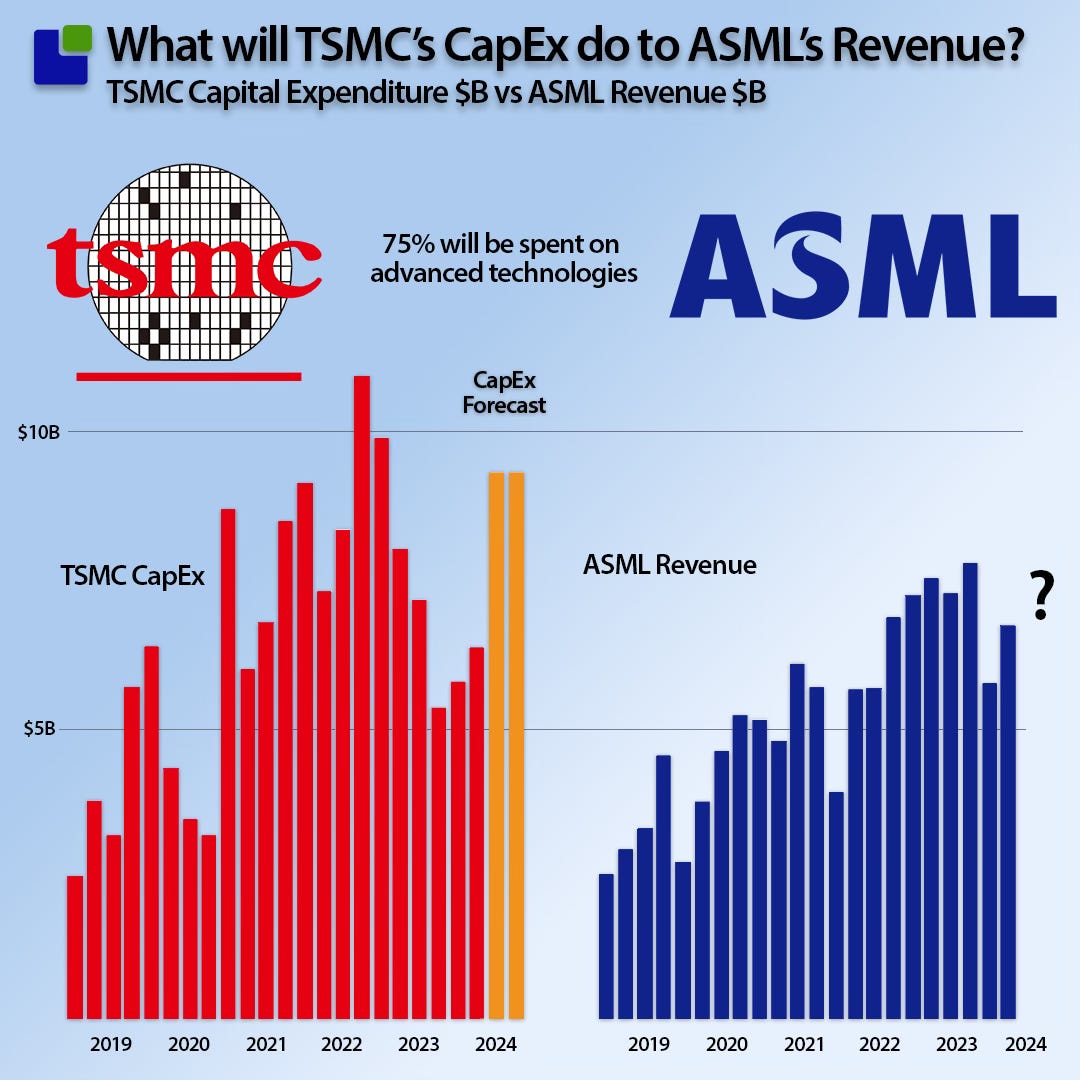

The other significant consumer of leading-edge tools is TSMC, which reported Q2-24 result right after ASML.

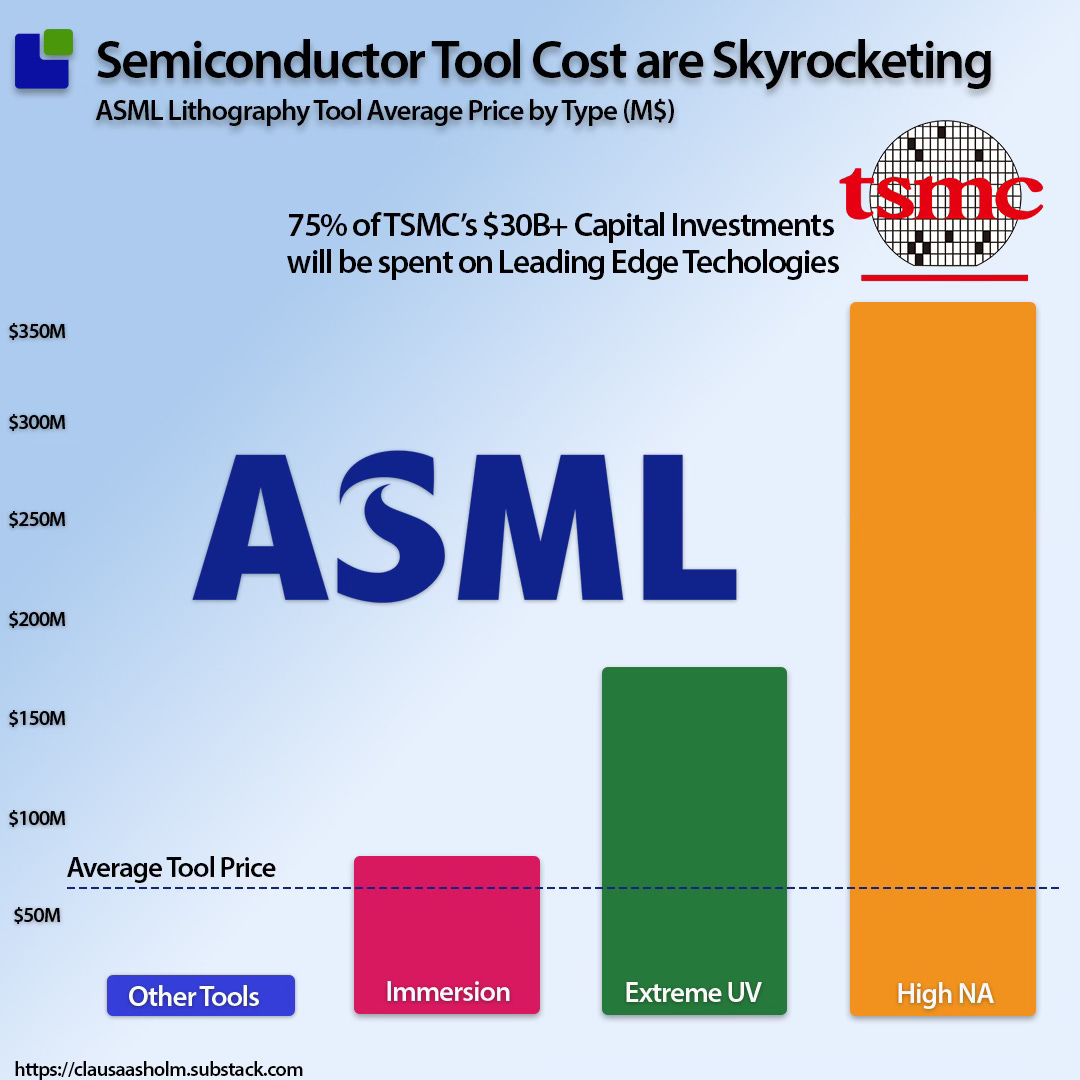

Although Capex spending was up, it was still just slightly above the maintenance investment level—the investment needed to maintain the deterioration of the existing manufacturing assets. TSMC is likely waiting for ASML’s High-NA tool to be available. ASML has confirmed they shipped one of these babies last quarter and installed another in Veldhoven on the joint IMEC/ASML manufacturing line. The tool is priced North of $350M, and ASML is trying to reach a production capacity of 20 systems annually during the 24/25 timeline.

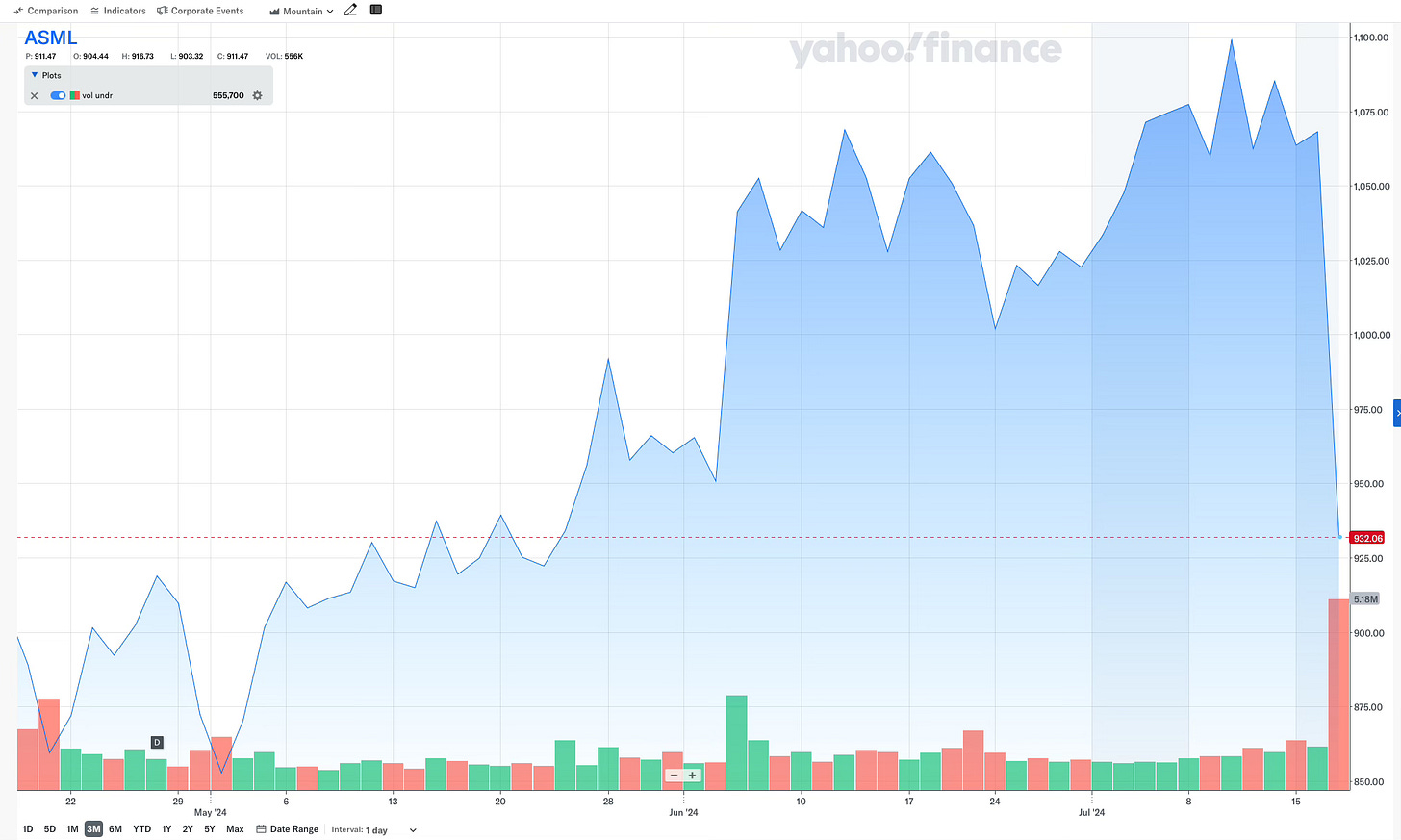

Despite beating the guidance and reasonable growth, the ASML share price plunged in the stock market. Are the markets losing confidence in the Lithography leader?

What about China?

The key reason for the share price decline is that the ASML result “coincided” with news that further export limitations are in the works.

The US and Dutch governments have already “agreed” on several Semiconductor Manufacturing Tools export restrictions for China. It is fair to say that the Dutch government is less enthusiastic than its US counterpart as the restrictions will negatively impact tax revenue and jobs in the Netherlands.

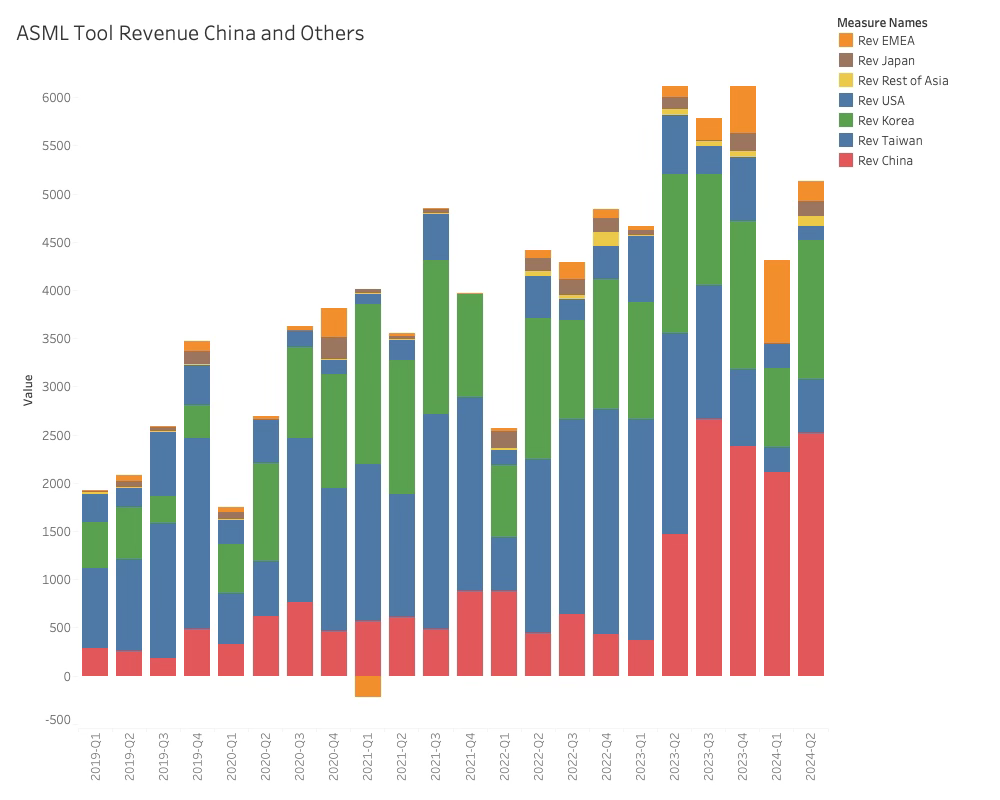

The embargoes have yet to have the desired effect on Semiconductor tool sales to China. Since the signing of the Chips Act, ASML tool sales to China have exploded.

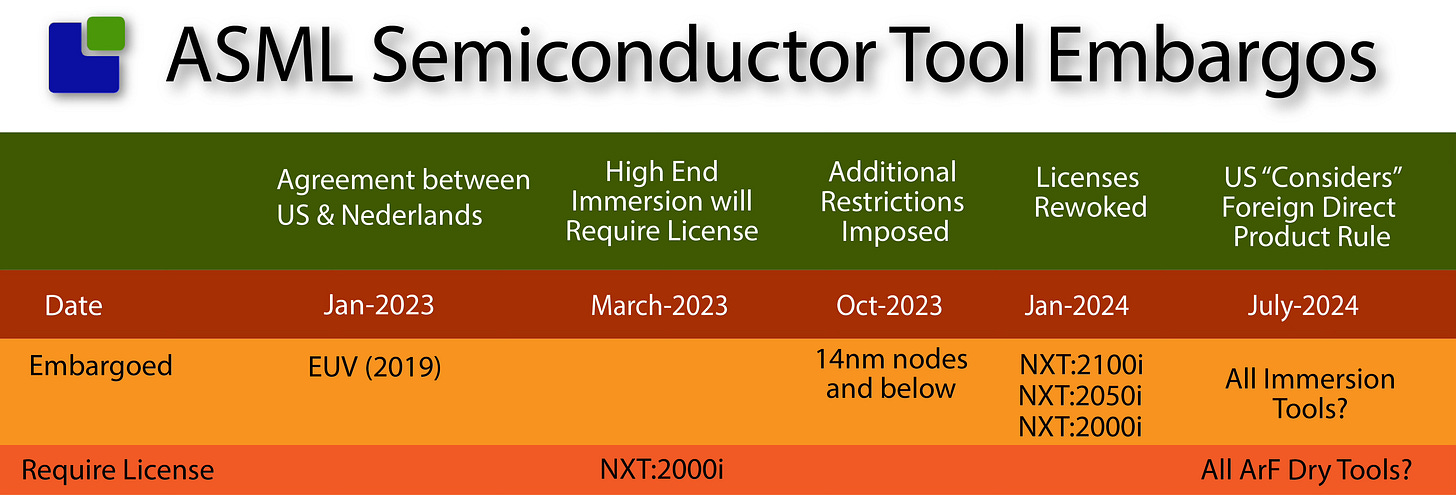

While Chinese companies have not had access to the leading-edge Extreme Ultra Violet (EUV) tools since 2019, they were able to buy Immersion tools until the agreement between the US and the Netherlands at the beginning of 2023. From March onward, the most advanced Immersion Tools required a license to be sold to Chinese companies. From there onwards, the screw has been tightened.

In principle, the embargoes have worked, but Chinese companies have continued to buy mature tools at an alarming rate for the US. Chinese dominance in mature technologies would be almost as scary as dominance in leading-edge technologies.

Tightening the restrictions has not had the desired effect, and the US government’s patience is running out.

On the same day ASML reported that China accounted for 49% of the company's revenue—the same as last quarter—the US Government announced that it is considering enacting the Foreign Direct Product Rule (FDPR).

The Foreign Direct Product Rule means that all products containing the smallest amount of US technology will be subject to direct US Export controls. This will effectively remove the Dutch authorities from the equation.

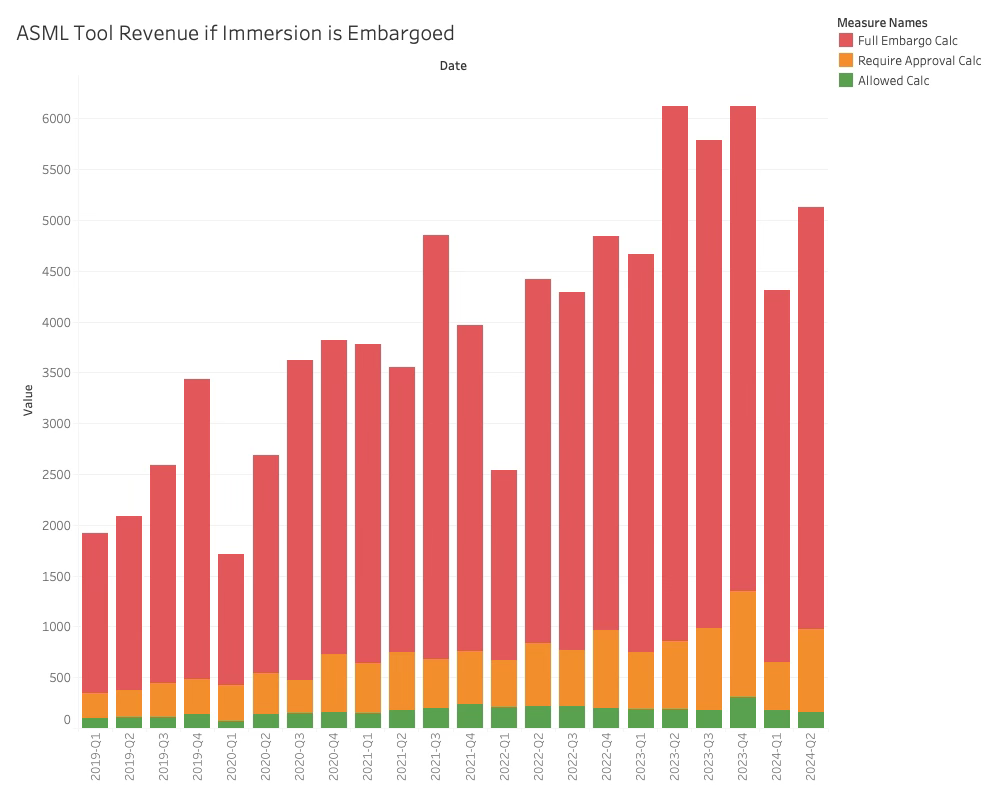

To get a serious reduction in tool sales to China, the US administration could decide to embargo all immersion tools and put license requirements on the ArF dry tools.

The ASML revenue in this scenario can be seen below.

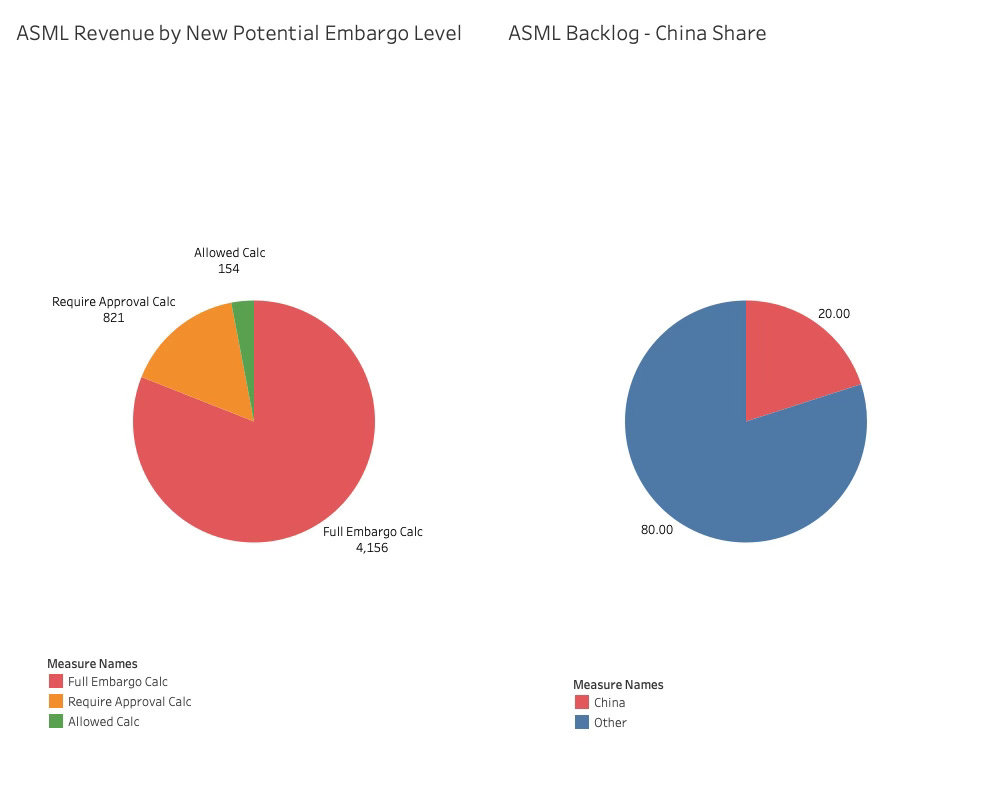

While this is a scenario, it is not without justification. The US government is hell-bent on reducing the revenue, and this scenario would limit the Chinese share of ASML revenue to a maximum of 20%.

Interestingly, this is also the share of the Chinese part of the ASML order backlog. This is not firm evidence, as the order horizon is likely longer for the more advanced tools that Chinese companies can access and sustain the revenue share with a much smaller share of the backlog. It is undoubtedly not sufficent to calm the US government.

A potential new FDPR embargo could also impact ASML's service revenue, which currently has a 24% share. Under a potential new embargo, ASML could lose the ability to service its Chinese customers, which is incredibly important for keeping the tools alive and productive. As the Chinese manufacturing base could deteriorate fast, this could create new opportunities for ASML as mature node capacity would grow outside China.

The longer-term view

We believe a dip in Chinese business and a potential embargo impacting service revenue is imminent, like the investors that are starting to panic and run away from ASML.

We also believe that ASML is an amazing company founded on a philosophy of long-term cooperation with its suppliers and other stakeholders. Constant innovation drives higher productivity, and tool pricing is reaching an alarming (for customers) level.

While each tool increases productivity, it is still a hefty price, but if you want to be at the bleeding edge of Semiconductor manufacturing, there is little choice.

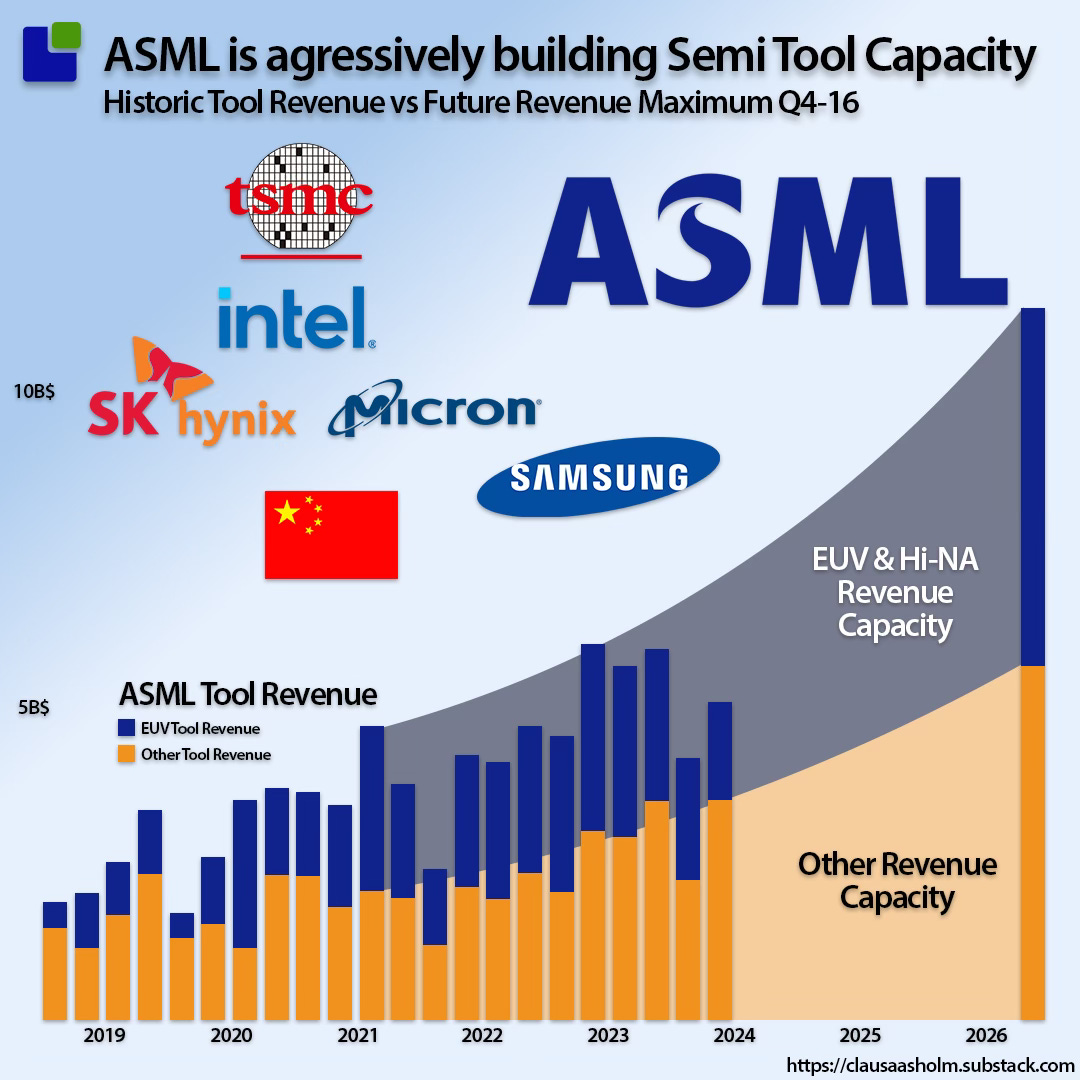

The current ASML manufacturing plan will enable the company to deliver a 12B$+ tool quarter (at current pricing) at the end of 2026. This is not a given or a forecast and can be changed according to industry development. However, it is a very strong indication that the company has faith in the long-term future of the current strategy.

TSMC narrowed their CapEx budget to 31B$ and as the company have only spent 12B$ there is a couple of high CapEx quarters ahead that could benfit ASML significantly.

Our research is focused on the business results and not on investment advice. However, if you have faith in the long-term plan of ASML, it might be too early to dump ASML shares.

Note: The content comes from the Internet, if it is inconsistent with the actual situation or there is infringement, please contact to delete.